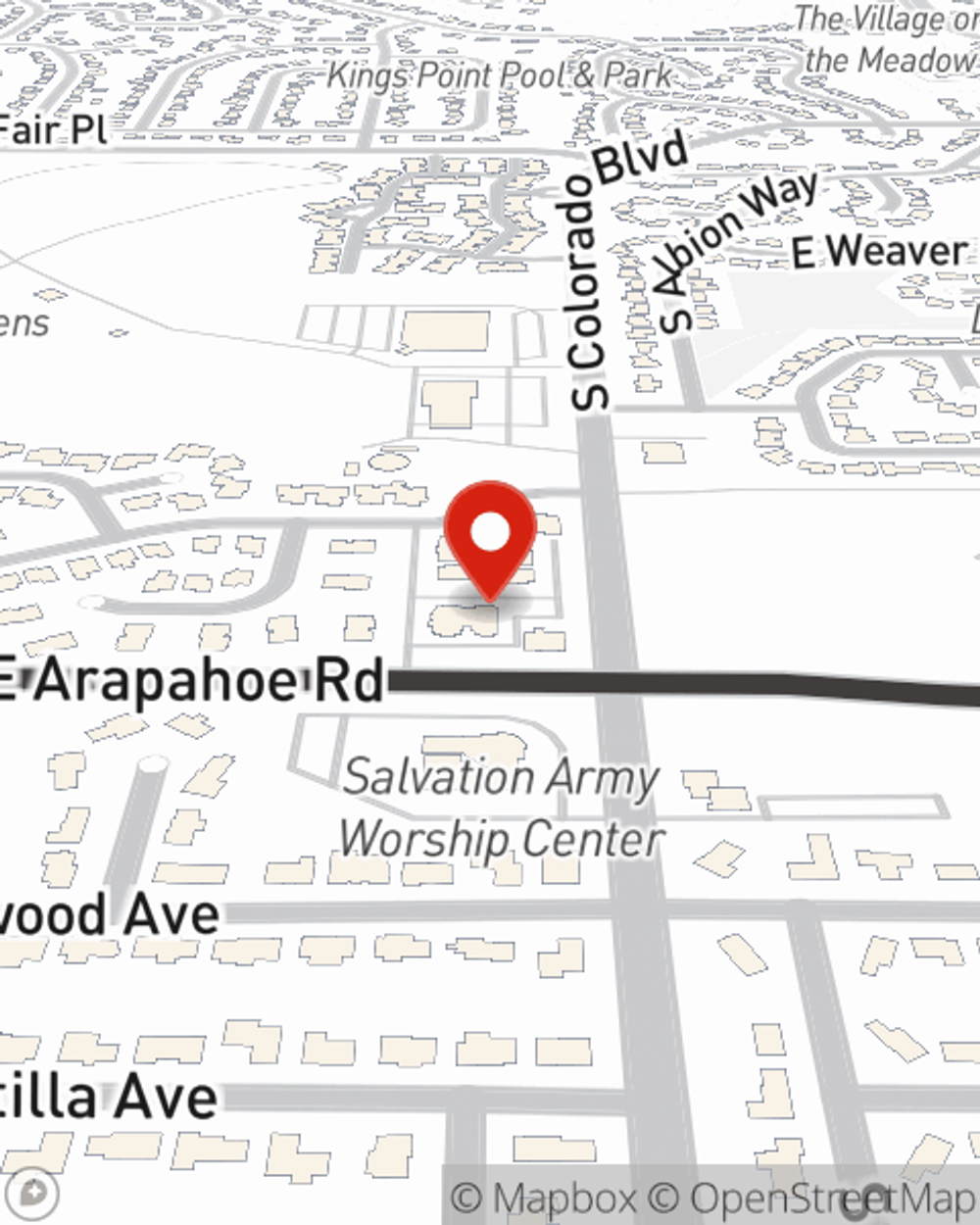

Life Insurance in and around Centennial

Protection for those you care about

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

There's a common misconception that you should wait until you're older to get Life insurance, but even if you are young and just starting out in life, now could be the right time to start looking into Life insurance.

Protection for those you care about

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with providing for children, life insurance is critically important for young families. Even if you don't work outside the home, the costs of finding other ways to cover before and after school care or housekeeping can be substantial. For those who aren't raising a family, you may have debt that your partner will have to pay or have a partner who is unable to work.

Did you know that there's now a life insurance option available that's perfect for someone who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really be helpful when it comes to supplement the financial options for final expenses like medical bills or funeral costs. Don't let these expenses overwhelm your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent H .Y. Chang for help with all your life insurance needs

Have More Questions About Life Insurance?

Call H .Y. at (303) 850-0740 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

H .Y. Chang

State Farm® Insurance AgentSimple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.